OUR PRODUCT

One Platform for Underwriting & Portfolio Intelligence

Parse.ai brings together everything credit, risk, and portfolio teams

need in a single platform—so you can underwrite loans, manage

portfolios, and optimize collections without needing large analyst or

data science teams.

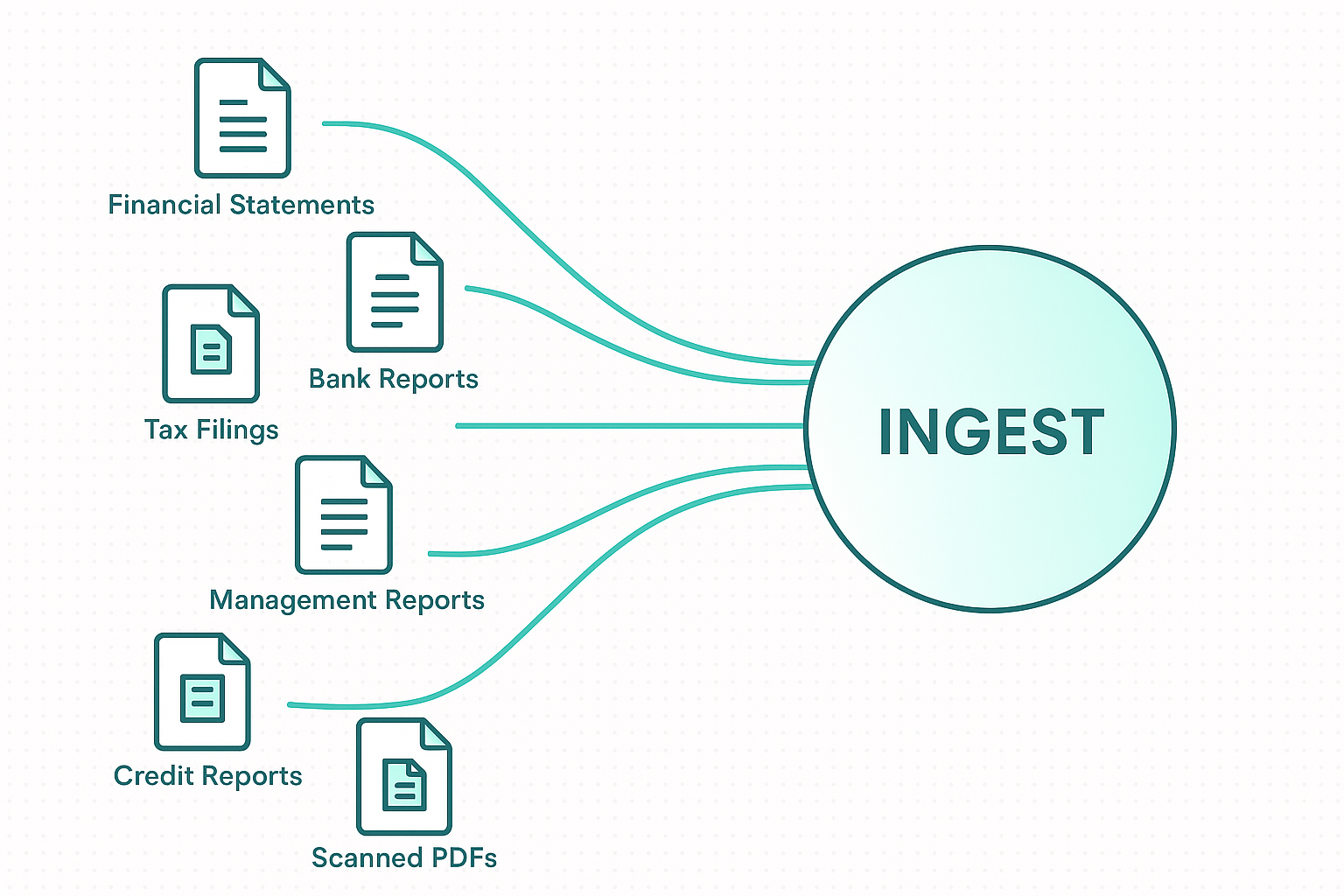

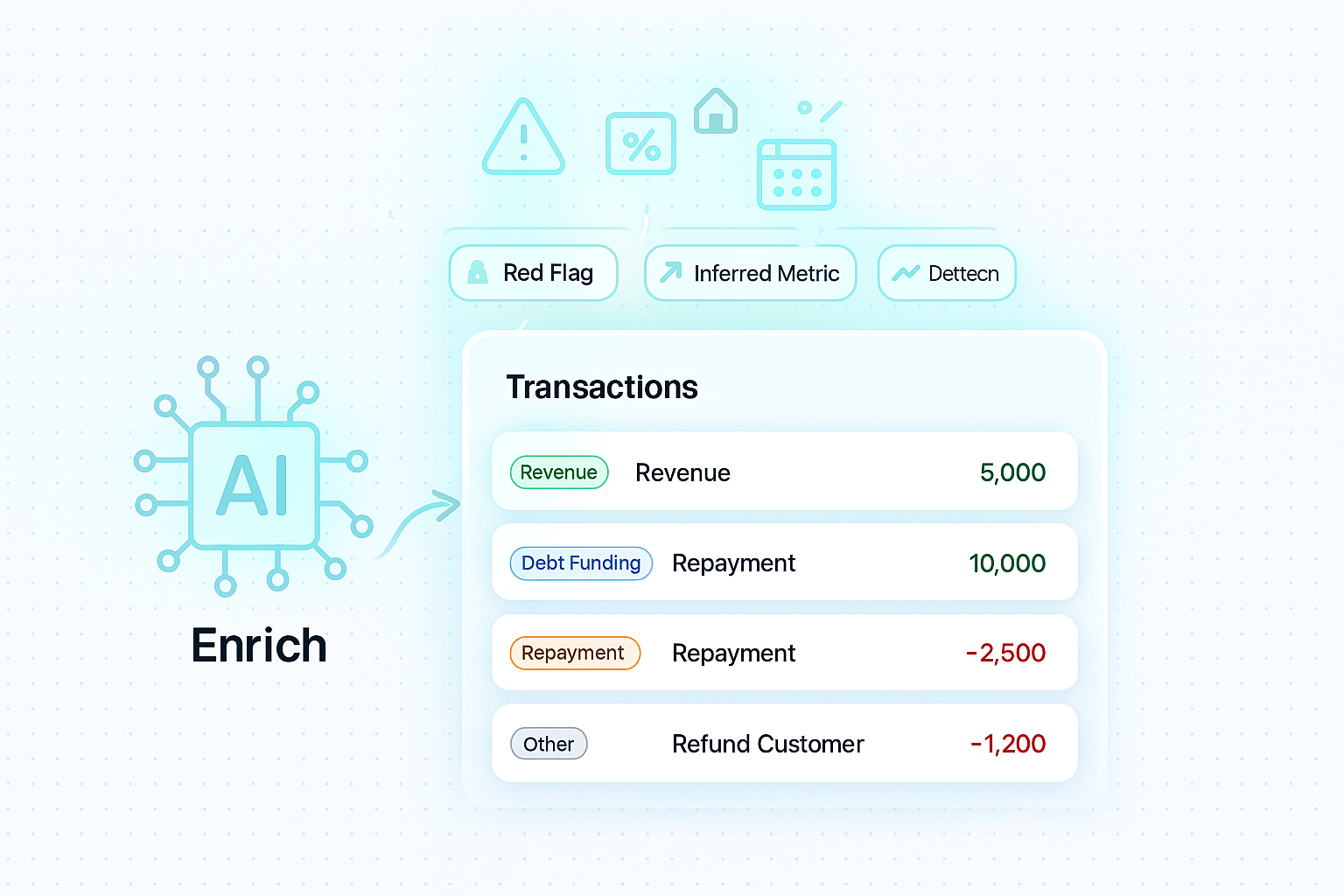

Commercial Loan Underwriting

Extract data from borrower documents, spread financials, and

generate credit memos aligned with your policies.

Portfolio Analytics

Visualize borrower and loan distributions, detect trends, and

identify concentration risks instantly.

Cohort & Vintage Analysis

Monitor loan performance by approval period, geography, or segment

to surface early warning signs.

Credit Risk Modeling

Predict defaults, losses, and portfolio stress outcomes with built

in deterministic models.

Collections Intelligence

Forecast recoveries, segment delinquent borrowers, and recommend

best fit collection strategies.

Stress Testing & Forecasting

Simulate economic scenarios and forecast future losses to support

portfolio resilience.

PARSE.AI: CREDIT UNDERWRITING AND PARSE.AI PORTFOLIO ANALYTICS